Invest in your pension using our Default Investment Option

This investment option is for customers who don't want to select their own pension investments.

What is a Default Investment Option?

If you are unsure about selecting funds for your personal pension and do not require financial advice, you may wish to consider the Default Investment Option. This option could be suitable if you want to have a flexible income during your retirement. The Default Investment Option may not align with your personal circumstances or financial goals. It's purpose is to grow your pension savings in the long term during your early and mid-career years. We automatically change where your pension savings are invested the nearer you get to your pension access age with the aim of minimising the risk of losing money. This is called a Lifestyle Profile.

The advantages and disadvantages of a Lifestyle Profile

Advantages

Disadvantages

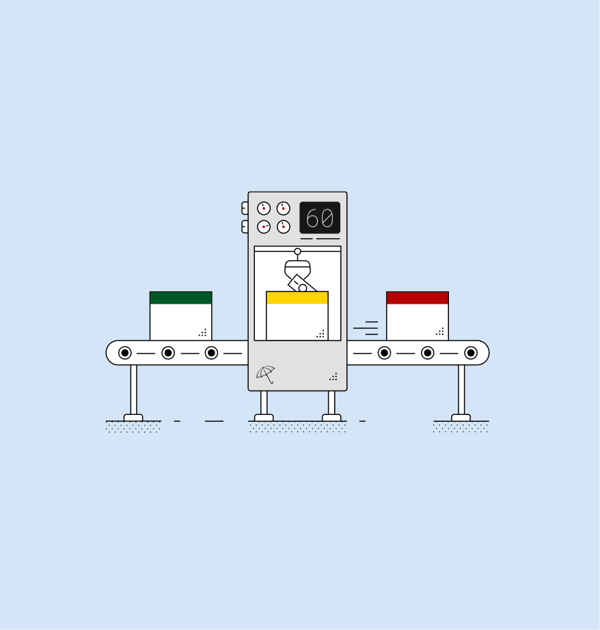

How does this Default Investment Option work?

The way your pension savings are invested can be divided into 3 separate stages:

Growth stage

When you are more than 15 years from your pension access age, your pension savings are invested with the aim of increasing the value of your pension pot.

Multi-Index 6 Fund (Medium Higher Risk)

Transition stage

When you are 15 years from your pension access age, your pension savings will move to a medium-risk fund, meant for growth while reducing potential losses during market turbulence.

Multi-Index 5 Fund (Medium risk)

Nearing retirement stage

When you are five years from your pension access age, we'll move your pension savings into a lower risk fund which is likely to have lower growth but aims to minimise potential losses during market turbulence.

Multi-Index 4 Fund (Lower Medium risk)

A lifestyle profile doesn't guarantee the value of your pension savings; the value of investments can go down as well as up. Currently once you have chosen the Default Investment Option you can’t switch to a different fund.

Other ways to invest your pension